Who is Credit Builders Alliance (CBA)?

CBA was created by and for our nonprofit members as a bridge to the modern credit reporting system to help millions of individuals with poor or no credit participate in the mainstream financial system by building credit.

CBA's platform of services helps shape our members' programs by connecting them to the credit bureaus to report loan payments and to pull reports for underwriting and financial coaching. We support practitioners through training and professional development opportunities.

How can we help you?

CBA membership

As a member of Credit Builders Alliance, you gain access to the best credit training, connections with a network of over 600 mission-driven organizations, the latest updates in credit building, access to discounted credit reports, and the ability to report loan data to the credit bureaus. You can strengthen your programs, help your staff's professional development, your organization, and your participants' lives.

CBA offers the following membership packages:

-

- Free toolkits, tipsheets, and resources to use with your participants via CBA's Training Institute (TI)

- Free monthly webinars to learn the latest in the credit building field

- Discounts on our signature Credit as an Asset on demand credit courses

- Discounts to our annual Credit Building Symposium

- Opportunities for funding and capacity-building through CBA Fund to start (or grow) a consumer loan program

-

- All community member benefits

- The ability to pull credit reports from up to 2 of CBA's credit bureau partners

-

- All community and access benefits

- Report up to 500 loans to all major consumer and/or commercial credit bureaus *

- Help with dispute management

Not sure what service package works for you or have questions about your current CBA Membership?

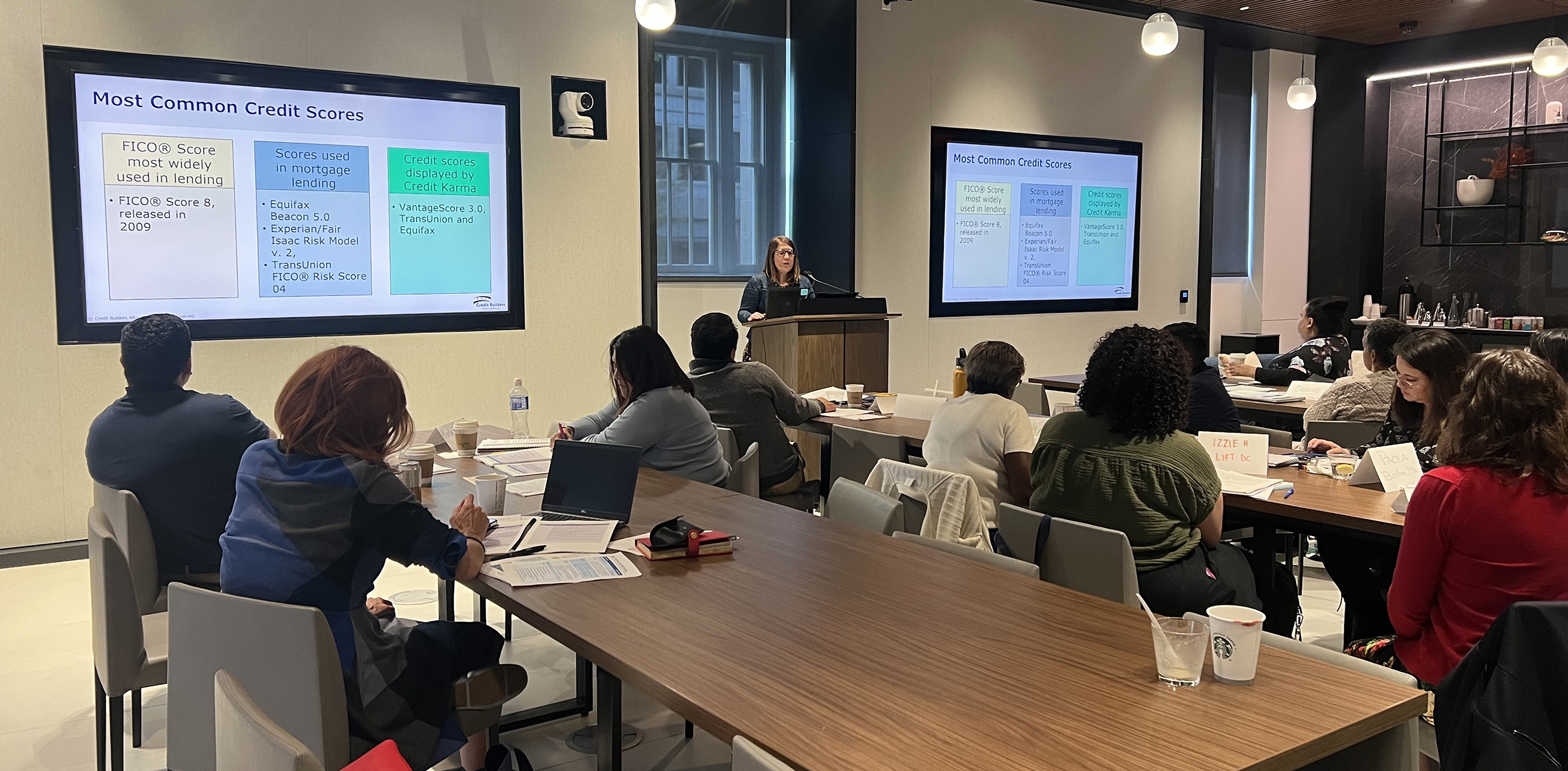

training

CBA has a proven track record of designing and delivering robust, relevant courses, toolkits, tipsheets, and resources to help nonprofit credit practitioners expand their credit knowledge. This also includes monthly community webinars and events that connect you with credit industry experts and other nonprofit practitioners.

The Training Institute (TI) hosts these valuable learning resources. Many are exclusive to CBA members, but many others are available to anyone with a TI account. Members also get discounted rates on our signature Credit as an Asset and Credit as an Asset: Small Business on demand courses.

REPORTING

Consumer Reporting

Help your participants build credit histories by reporting their loans to the major consumer credit reporting agencies.

Business Reporting

Strengthen opportunities for your business participants by reporting their loans to the major commercial reporting agencies.

Rent Reporting Center

Reporting rental payments to the credit bureaus is an evidence-based strategy that can help renters increase their credit scores.

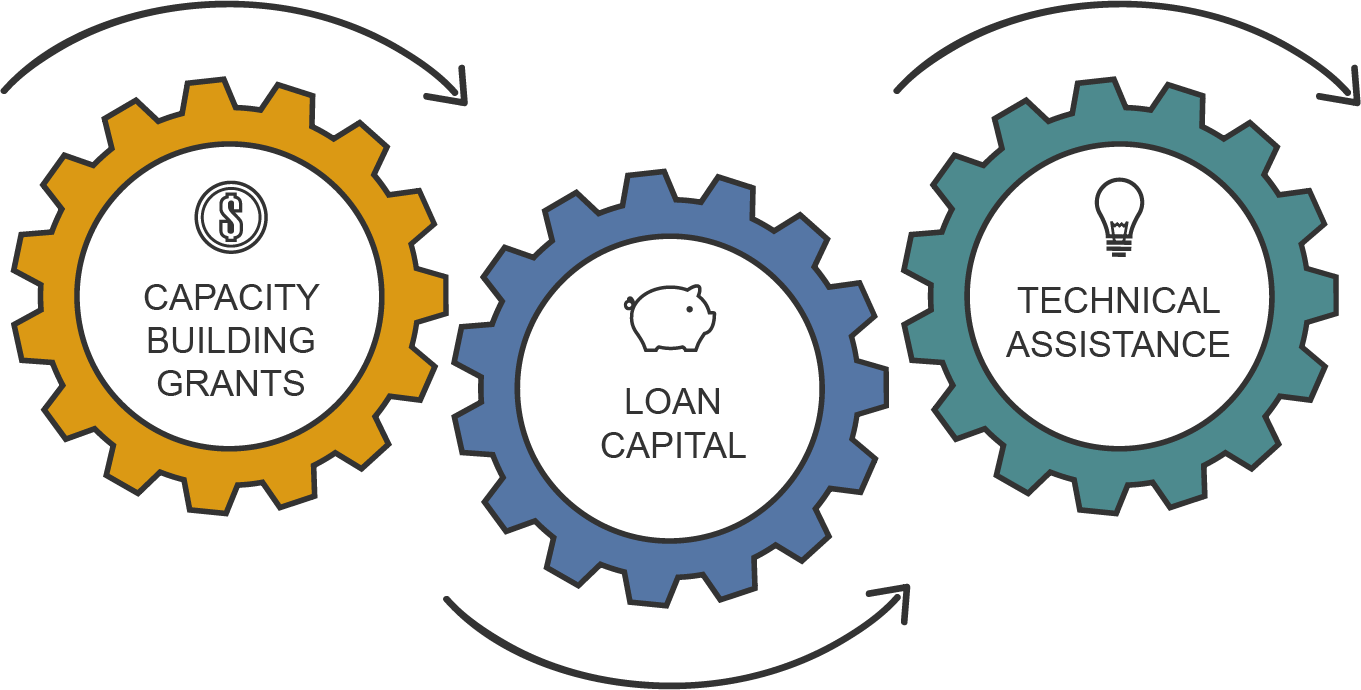

FUNDING & SUPPORT

CBA Fund

CBA Fund is a Community Development Financial Institution (CDFI) intermediary dedicated to expanding the capacity of nonprofits to provide safe and affordable small dollar consumer loans (SDLs) and credit building products in their communities.

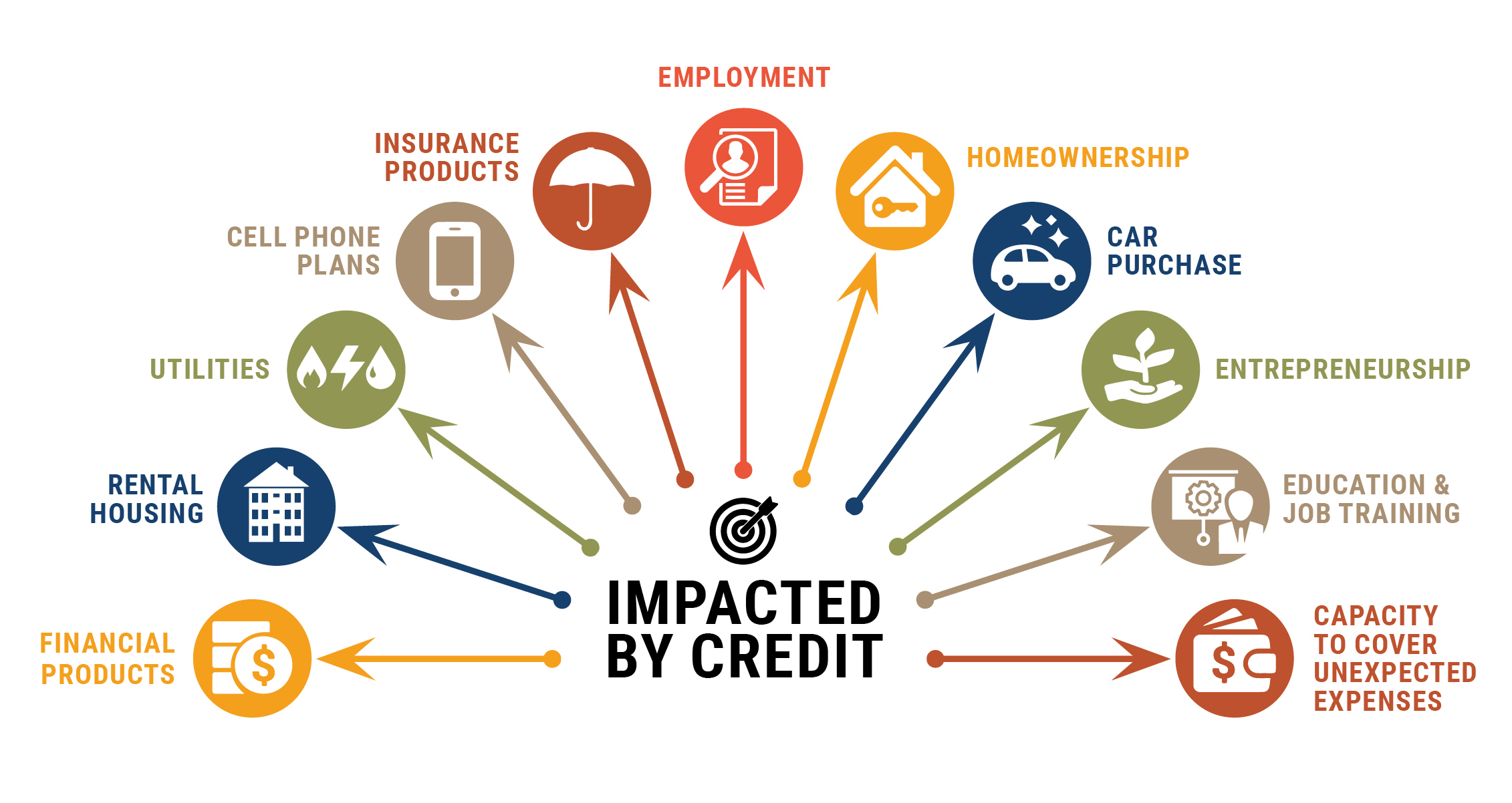

consumer credit stories:

perspectives on credit realities

Credit Builders Alliance partnered with four Master Trainers-experienced credit building practitioners from organizations across the country-to conduct interviews with historically marginalized individuals about their experiences with credit. Participants share the realities of external structural challenges and difficult internal choices.