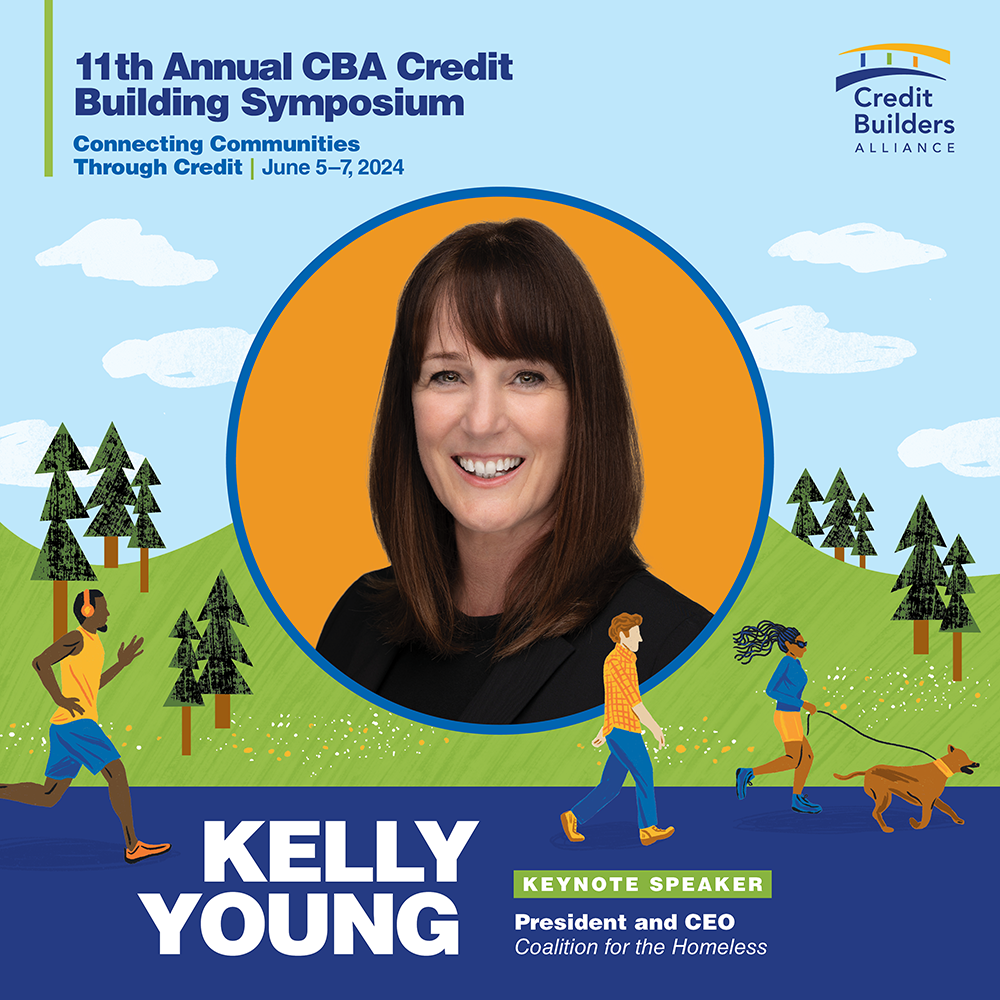

Connecting Communities through Credit

keynote speakers

KELLY YOUNG

JEFFREY FUHRER

Jeff Fuhrer is a Nonresident Fellow at the Brookings Institute and a Foundation Fellow for the Eastern Bank Foundation. He began his career at the Board of Governors of the Federal Reserve of DC and has spent years researching and advising the Federal Reserve banks. Jeff has more than three decades of economic research, covering interactions among monetary policy, inflation, consumer spending, and asset prices.

In September 2023, he released his new book, The Myth that Made Us, via MIT Press. This book exposes how false narratives – of a supposedly post-racist nation, of the self-made man, of the primacy of profit- and shareholder value-maximizing for businesses, and of minimal government interference – have been used to excuse gross inequities and to shape and sustain the US economic system that delivers them.

venue

Grand Hyatt Hotel

1000 H St NW

Washington, DC 20001

(202) 582-1234

PRICING

Please carefully review the Duty of Care regarding health precautions prior to registering.

REGISTRATION

MEMBERS AND ALLIES

STANDARD RATE

sponsors

PREMIERE SPONSORS

SUPER PRIME SPONSORS

PRIME SPONSORS

SPECIAL SPONSORS

EXHIBITORS

- AFCPE

- Change Machine

- CoreLogic

- Downhome Solutions

- FDIC

- NeighborWorks

- OFN

- Self

Highlights from our 2023 Symposium

SESSIONS

- Achieving Community Goals through Collaboration and Relationship Building

- Recognizing and Capitalizing Informal Community Financial Networks

- Overcoming Systemic Economic Barriers through Credit Building Programs for Historically Marginalized

- Today’s Youth, Tomorrow’s Credit

- Rent Reporting: A Safe and Low-Barrier Tool for Financial Inclusion

- Safe and Affordable Small Dollar Loans

- Financial Education and Consumer Rights

- Building Strong Financial Foundations: Supporting Marginalized Small Business Owners

- No Credit Score, No Problem: Building Financial Equity through Alternative Credit Data

- Lease-to-Purchase: How to Build Homeownership

- FOCs® are Advancing Credit Building and Savings through the Lens of Families with Low Incomes

- When Furnishers Suppress: Implications for Consumers

- Building Culturally Competent Programming for Credit Invisible Clients

- Bridging the Credit Gap

past presenters

Dr. Jackie Scott

John McNamara

Cy Richardson

Anne Price

Laurie Ruben

Jovita Carranza

Noel Poyo

Donovan Duncan

Melissa Koide

Bola Sokunbi

code of conduct

Attendees are expected to observe appropriate behavior during the event. This includes, but is not limited to, respect for the presenters, host, and other attendees and a prohibition on any abusive behavior while using the Attendee App. Attendees are not permitted to share any malicious files or information, or spam, and are prohibited from using offensive, threatening, or violent language when contacting other attendees electronically. The ability to participate and format for said participation is at CBA’s sole discretion, including the ability to verbally or electronically interact with other attendees. CBA reserves the right to remove or restrict any attendee from using the online Attendee App due to a violation of these terms and to enforce bans from future sessions or events.

* Please carefully review the Duty of Care regarding health precautions prior to registering.